"Math: The great enemy of the salon suites franchisor."

Despite salon suite franchise claims to the contrary, their interests and yours as a franchise operator are NOT aligned! The franchisor does NOT care about how much money you KEEP, he is ONLY concerned with how much you GENERATE! Look at this:

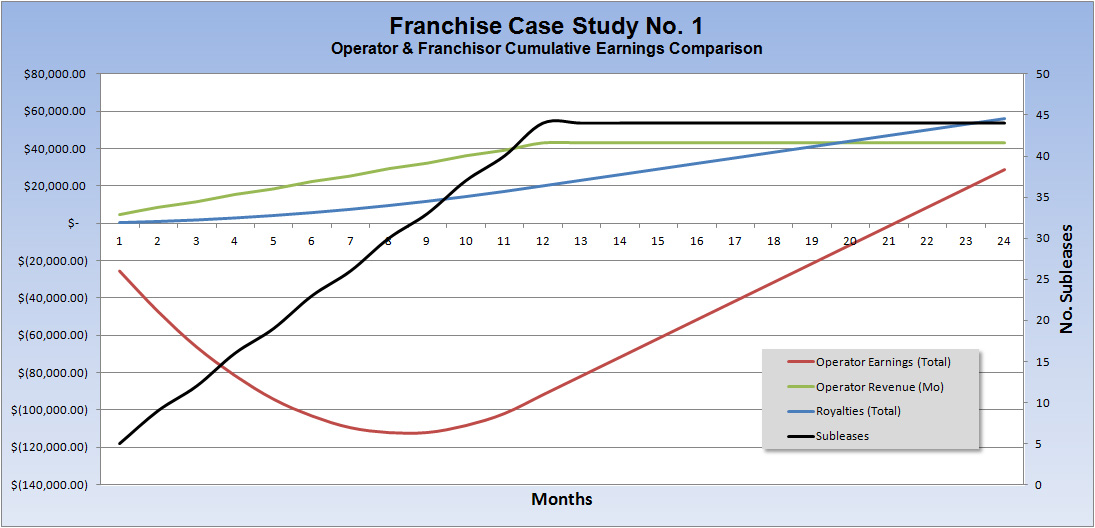

Here is a quick case study showing how interests are NOT aligned. (We will utilize a common model with the same assumptions that many franchisors use during the hard sell of the franchise exploration process.)

Despite salon suite franchise claims to the contrary, their interests and yours as a franchise operator are NOT aligned! The franchisor does NOT care about how much money you KEEP, he is ONLY concerned with how much you GENERATE! Look at this:

Here is a quick case study showing how interests are NOT aligned. (We will utilize a common model with the same assumptions that many franchisors use during the hard sell of the franchise exploration process.)

The horizontal axis represents months, starting at opening, and covers the first two years of operation. The black line shows the assumption of fill rate to 90% occupancy, while green represents the classic salon suites monthly gross revenue curve (linear ramp, leveling off as occupancy approaches capacity). The relevant lines on the chart are blue (cumulative Royalty Payments) and red (cumulative Operator Earnings), which show that even though the operator is experiencing heavy operating losses, the franchisor is raking in enormous royalty revenues (negatively impacting the red earnings line). The operator does not achieve cumulative positive net until sometime around Month 21, while the franchisor is making money from Day One. Most alarming is that the cumulative earnings curves don't cross until after Month 24(!). (In other words,the operator doesn't catch up to the franchisor's earnings for at least the first two years!)

The franchisor's only real interest is in the green line (Gross Revenues), while the operator's attention is focused on the red line (Net Earnings). Their interests are hardly aligned, and the claim that the franchisor makes money only when the operator makes money is disingenuous as it doesn't include the entire picture. Since the franchisor's compensation (blue line) is only relative to gross revenue (green line), is he truly motivated to save the operator development costs or to maximize operating cost efficiencies? Not really.

His ONLY interest in is the operator's revenue stream. Maximizing the operator's net earnings is not his priority. Thus, lowering your debt load, or minimizing construction and operating costs, which include HUGE royalty fees, are irrelevant to him! As long as your tenants are paying rent, the FRANCHISOR DOES NOT CARE ABOUT YOUR EARNINGS, ONLY YOUR REVENUE.

Typically, a franchisor will focus on showing the potential operator cash flow and profitability under the assumption of 100% occupancy, with great lease rates, in an unreasonably large facility, but rarely is the non-correlation between their interests addressed. Even the most casual reader will note that by avoiding excessive and unnecessary franchise royalties, the red curve flattens and shortens considerably (i.e. it crosses the x-axis of positive cumulative earnings much sooner).

(Note: The assumptions used in this case study are highly variable based on location, facility, landlord concessions, etc. It does not account for step-function or nonlinear real-world fill rates, typically high turn-over rates in the first two years, competitive environments, etc. It is not intended to provide analysis of any particular salon suites project or facility, and the assumptions made should not be applied to any pro-forma analysis without site-specific data. As different model assumptions are input, output data causes the resultants to expand or contract horizontally, or compress or expand vertically, but all models follow the same basic relative curve structure.)

If you have your heart set on buying a franchise and taking on the huge additional costs they incur, there are at least 23(!) by our count operating today: Sola, Phenix, Salons by JC, A Suite Salon, My Salon Suite, Studio Salons, Salon Spa Suites, Salon Plaza, Cirque Salon Studios, Image Studios 360, Salon Boutique, Universal Salons, Mimosa Salon Suites, Encore Salon Suites, Cosmopolitan Suites, Salon Concepts, Mix Salon Studios, Beauty Bungalows, Salon Studios, Spectra Salon Suites, Utopia Modern and Optima Salon Suites. Shop around, but why bother? You can accomplish the exact same objective at a fraction of the price. See how by clicking here.