|

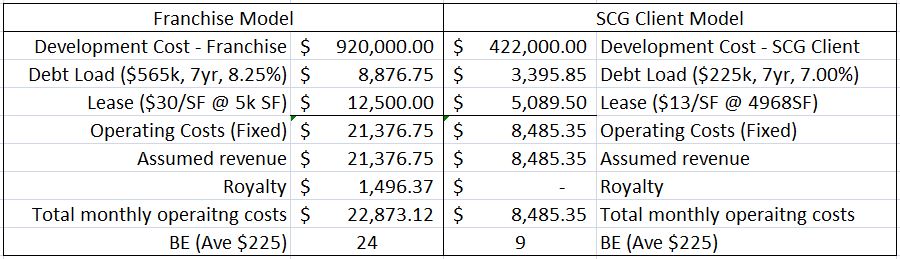

Competition: Independent operators competing with a franchise – this is not a fair fight! As an example of how this principle manifests itself, here’s a real-world example. (This is an actual franchised facility development in the same market as an SCG client. We’re not making this up. We couldn’t because nobody would believe us.) In this case study, both facilities are roughly 5000 square feet and yield 28 suites each. Leverage - Many (if not most) franchisees are highly leveraged due to the additional costs associated with a franchise development (click here for more detail on franchise development costs). In this case, the operator is carrying an initial debt load of $565k(!). That equates to a high monthly P&I burden of over $9000. Unfortunately for this particular franchisee, he went with an unconventional financing source, which typically means less favorable terms. By comparison, the SCG client is carrying a reasonable debt burden due to much lower development costs.

Rent – Franchises often encourage their franchisees to seek out high-end retail locations, under the belief that these sites will equate to higher sublease rates. In an ideal, non-competitive environment that is generally true, but few non-competitive environments exist. And if they do, they won’t be that way for long. For this particular client we identified a great property in a high Class B retail center, and it is beautiful. The landlord even threw in some exterior improvements to their specific space in addition to making improvements to the entire development. Benefit to the operator? $13/SF vs $30/SF, or about $7500/month cash-in-pocket. Royalties – Heavy for the franchisee, free for the independent! Assumed Revenue - For the purposes of this study, and to eliminate as many variables as possible, we assume that gross revenue covers fixed expenses and nothing else (in order to determine associated royalty costs). Break Even – Here’s the sad part for the franchisee. Using ONLY fixed operating costs, this franchisee will have to fill 24 of his 28 suites (assuming $225 average rent, which is frankly generous in this case) just to break even! Our client’s equivalent number is 9, leaving lots of room for operating profit in the remaining 19 suites. Add other expenses (utilities, insurance, facility cleaning, supplies, phone, misc repairs, etc.), and the franchisee is realistically closer to requiring a break-even sublease rate of 26 out of his 28 suites(!). Now let's assume that he fills to capacity, and he's making a profit off those last two suites at $225/week. (We're actually being generous here because we're not even considering his additional royalties) That equates to an annualized net of about $23,000, on an investment of over $900k. All those that think this is a good business plan please raise your hand. Note: This SCG client understands the meaning of a competitive environment, so we included several design upgrades, which resulted in a beautiful facility, inside and out. In our opinion, the client’s property is easily equivalent to the franchise property from a design and ambiance perspective, and it obviously it surpasses the cookie cutter franchise approach. Probably the most eye-opening aspect of this study is that this model is NOT an outlier. This example is just one of many, and is probably typical. Many, many franchisees are in operation around the country that are creating great gross revenue streams, but making very little money. Remember, this is fine with the franchisor's bottom line because their income is tied to the franchisee's gross revenue, not their net.

0 Comments

Leave a Reply. |

Welcome to our BlogWe hope you find something useful here. Don't hesitate to contact us if you have any questions! Archives

April 2020

|

If you have your heart set on buying a franchise and taking on the huge additional costs they incur, there are at least 23(!) by our count operating today: Sola, Phenix, Salons by JC, A Suite Salon, My Salon Suite, Studio Salons, Salon Spa Suites, Salon Plaza, Cirque Salon Studios, Image Studios 360, Salon Boutique, Universal Salons, Mimosa Salon Suites, Encore Salon Suites, Cosmopolitan Suites, Salon Concepts, Mix Salon Studios, Beauty Bungalows, Salon Studios, Spectra Salon Suites, Utopia Modern and Optima Salon Suites. Shop around, but why bother? You can accomplish the exact same objective at a fraction of the price. See how by clicking here.

RSS Feed

RSS Feed