|

We have a lot to say about this, but please read through it. These issue may end up costing you a lot of money for zero benefit.

The partners at Suites Consulting Group have been involved in the salon suites industry as developers and operators longer than any of the franchises have been around. Years ago, when we noticed these franchises start to pop up, we were mystified as to why ANYONE would buy one. When we saw them continue to grow (there are at least 17 today), we decided to offer our services as a math and data-based approach, with much more comprehensive, thorough, and cost-effective solutions that put the interests of the developer's long-term success first. In recent years, we have also seen other salon suites "consultants" emerge, but be aware of experience and background. To our knowledge, none have developed more than one or two, and some can provide no evidence that they have actually developed ANY. Almost all have attempted to become clients of SCG, but have been rejected for a number of reasons. We typically carry ten to fourteen open project development files at any one time, with several multiples of that completed. A beautiful website does not necessarily portray reality, so look deeper. There are some shady claims made, so be aware. Some red flags:

to make it. 2. It is very important in this industry that the operator have an interpersonal relationship with every tenant, which is established at the initial contact and through the leasing/on-boarding process with every tenant. Any legitimate operator with experience in the industry will acknowledge this and confirm that the operator (using the best tools as provided by SCG) is the party to lease up the facility, not some anonymous voice on a phone somewhere. 3. Feedback we have received is of charges of $1000(!) per sublease, so you're looking at potentially $30,000 MORE for something you can (and should) be doing yourself for free! Bottom line: "Caveat emptor" (buyer beware) when considering such an important decision. Suites Consulting Group has been providing high quality salon suites consulting services to the industry for longer than all other "consultants" combined, We have a long track record of success, and can provide the highest quality and cost-effective solutions for your development as well. Compare and you'll see for yourself. For those without access to the details of franchise start-up costs, here's a primer. These numbers are taken straight from one of the larger franchisor Franchise Disclosure Document (FDD), and keep in mind, these fees are up front before you ever sign up a single tenant:

1. Initial Franchise Fee - $45,000.00 (Unless you are a current franchisee or purchasing multiple franchises, then you get the bargain basement price of only $35,500.00) 2. Site Evaluation Fee - $2000.00 per site you consider. If it does not meet their "standards", start over and pay another $2000.00 for EVERY ADDITIONAL SITE you look at. 3. Location Compliance Fee - $6000.00 this is the cost for the franchisor to review your space plan. This is NOT your architectural fee, which typically runs $18k-$25k. This is the fee you pay for the franchisor to REVIEW the plans. 4. Collection Book - $20.00 Required for every tenant. If you have 30 tenants in your building, that's an additional $600.00(!), for ... what? ... a ledger book? Have we never heard of spreadsheets and electronic processing? 5. Initial Inventory - $5000.00-$20,000.00 For this particular franchisor, you are required to purchase the franchise's own branded beauty products for your store. Never mind that these are not commonly-used products outside of this franchisor's domain, and that stylists typically like to use their own product sourced from their own suppliers, or that you would be competing with and undermining your tenants' ability to sell their own retail product and boost their own business success. But it DOES provide another potential revenue stream for the franchisor. Of course, there are plenty of follow-on fees (training, television, education, suites tour technology(?), etc.). Some are optional, but our favorites are: 1. Royalties - Enough said on this one 2. Grand Opening Celebrity Request - This particular franchise attempts to promote one of their founders as some kind of "celebrity", and we suppose the assumption is that her mere presence at a site will draw screaming fans wanting her autograph, bringing the franchise added publicity. Or something. By popular demand, we are re-posting this article as it contains several warning signs regarding how things can go poorly without proper oversight.

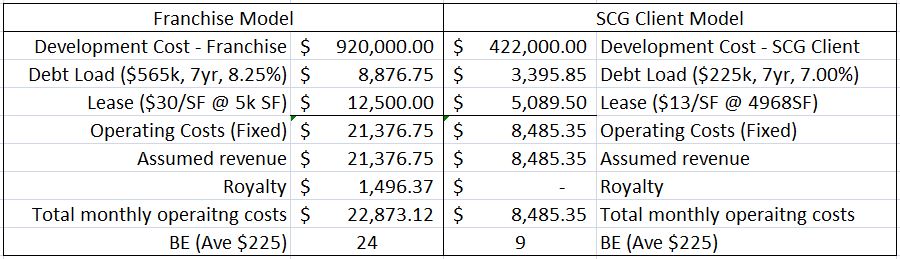

___________________________ In order to stay up on the industry and its latest trends for our clients, we routinely interview owners of recently opened or under-construction salons suites facilities, franchised or independent, and then follow up a year later to gauge their experience. One of our partners had an hour-long phone call this week with a recent franchisee of one of the “big six” franchisors. Here's what he told us: This franchisee was pretty smug and confident when we started our discussion, but by the end of our talk, I think he was seriously regretting his decision, realized there wasn’t anything we could do for him, and that he was stuck. He paid a $45,000 franchise fee, and in return he essentially got a set of guidelines, a pat on the back and a “go get ‘em tiger”. No help with site selection other than some advice on rejecting a few locations, no site due diligence (a major issue was revealed during demo), no lease advice from the franchise or verbiage that would hold the landlord accountable for something like that, no design or space planning, some ridiculous marketing advice and was (in our opinion) sold a bill of goods regarding the strength of his position and the competition, which is significant. He was basically on his own. From the numbers he shared, he may never get a return on his capital and it is going to take him a very long time just to get to break even on monthly cash flow (if he ever does). The loss of his retirement nest egg is a very real likelihood. During our conversation, he told shared several reasons why he invested in the franchise and chose his location. 1. "Beautiful facility design advantage" He was convinced by the franchisor that his product will allow him to compete easily in any market. ("The quality of my product is so great that we won't have problems attracting tenants.") The reality is that three other operators in very close proximity also have quality product (beautiful facilities), with a fourth to be built soon. He seemed to not realize that once a certain design threshold is met, the advantage of one over the other becomes an issue of personal taste, with no advantage for this franchisee. We pointed out that none of his competition is a "ghetto" facility and any advantage he thinks he has is one of subjective taste. The design advantage scenario might be realistic for a new operator moving into an area with an old, run-down or dated facility, but the perceived advantage of a "beautiful design" diminishes or is eliminated when other operators have reached that same threshold. Later, after reviewing his plans, it was obvious that in an attempt to squeeze as much rentable space as possible into the facility, he had created suites that are typically smaller than his competition. While on the surface that might not seem significant, tenants are VERY aware of this, as they carefully evaluate a space since they will be spending so much of their time there. 2. "Financial advantage" His site has three other operators in his direct vicinity (with another planned), all independents with no royalty obligations, but somehow he has been convinced by his franchisor that he can compete with them even though he has a burden of nearly $40k/year in royalty fees that his competition does not have (not to mention his huge up-front franchise fee). That's like starting a marathon carrying a 30lb backpack. Since he didn't get much help from the franchisor with his lease (he was directed to find a local broker for help (another bad idea)...more on that later), he ended up with what he thought were great lease terms, when in fact, they are not competitive at all. Additionally, in order to establish his franchise, he has taken on a huge debt load, a burden that at least two of this three competitors do not have. So in summary, he is carrying a royalty obligation, bad lease terms, and a huge debt load, and now he has to go compete? That backpack just got loaded to about 75 lbs. 3. His market's over-supply of product/competitive evaluation After we reviewed his "design and financial advantages", we talked a bit about his market. He located his facility right across the street from a long-established independent, and within a quarter mile of two other facilities that had opened within the last year and are only about 30% filled. In his direct vicinity, there are approximately 40 open suites available, and he is adding 37 more to the market. Additionally, the long-established operator across the street from him has ten facilities in the area, and is planning another about five miles away. Historically, when this operator opens a new site, he partially populates it with tenants from his other facilities that live closer, so chances are that another 10-20 suites will be added to the market, all of them in beautiful facilities. That brings the total of available suites to roughly 90-100 (a HUGE number in just a quarter-mile radius). It is likely to take him years to fill his facility to a break-even point. This problem is exacerbated by the fact that one of these other operators appears to be in a desperate cash-flow situation and has been steeply discounting his suites, driving down the price for all operators in the area. 4. Pro forma analysis This franchisee told us that he has $850k(!) into the project (includes everything: franchise fees, construction, start-ups costs, etc.). While on the phone we plugged his numbers into our spreadsheet, and we were was just astonished. Not even having all the information, it appears that, in a BEST CASE scenario, with aggressive occupancy and high lease rate assumptions, he will net about $40-$50k per year. That is not a very good ROI on an actively managed investment, and he likely has 18-24 months of negative cash flow until then. While his position is that he only has a small portion of his own capital invested, he seemed to not realize that his highly leveraged start-up has him personally on the hook for that huge amount through personal guarantees, and will prevent him from expanding once he submits his balance sheet to get more funding for future facilities. 5. What he got from his franchisor As we continued our discussion, he explained that he was starting to realize that he didn't get much help from his franchisor. He was provided with a set of guidelines, some encouragement and some exciting stories about other franchisee's successes, and then was essentially released to build his business. (He also told me about the marketing advice he received, some of which bordered on the ridiculous.) Some due diligence and a guiding hand from an experienced operator would have gone a long way to helping him avoid much of this, but for the most part, he realized that he was on his own. The worst part was that if he could make this work and wanted to expand, he was stuck in a obligation to the franchise, so there was no way out. Summary So much went wrong with this, but it’s a common story. This poor franchisee likely has some sleepless nights ahead of him. At the end of the day, the franchisor has his money and a significant percentage of this poor guy’s future revenue stream…and for what? We feel badly for him, truly. Anyone going into a franchise situation should be aware of what is truly deliverable and what isn’t. Our experience generally is that franchisees are on their own much more than they expect to be. Don't be taken in by someone else's success story. Every market is different, and the risk is too high to not perform due diligence seriously and thoroughly. Competition: Independent operators competing with a franchise – this is not a fair fight! As an example of how this principle manifests itself, here’s a real-world example. (This is an actual franchised facility development in the same market as an SCG client. We’re not making this up. We couldn’t because nobody would believe us.) In this case study, both facilities are roughly 5000 square feet and yield 28 suites each. Leverage - Many (if not most) franchisees are highly leveraged due to the additional costs associated with a franchise development (click here for more detail on franchise development costs). In this case, the operator is carrying an initial debt load of $565k(!). That equates to a high monthly P&I burden of over $9000. Unfortunately for this particular franchisee, he went with an unconventional financing source, which typically means less favorable terms. By comparison, the SCG client is carrying a reasonable debt burden due to much lower development costs.

Rent – Franchises often encourage their franchisees to seek out high-end retail locations, under the belief that these sites will equate to higher sublease rates. In an ideal, non-competitive environment that is generally true, but few non-competitive environments exist. And if they do, they won’t be that way for long. For this particular client we identified a great property in a high Class B retail center, and it is beautiful. The landlord even threw in some exterior improvements to their specific space in addition to making improvements to the entire development. Benefit to the operator? $13/SF vs $30/SF, or about $7500/month cash-in-pocket. Royalties – Heavy for the franchisee, free for the independent! Assumed Revenue - For the purposes of this study, and to eliminate as many variables as possible, we assume that gross revenue covers fixed expenses and nothing else (in order to determine associated royalty costs). Break Even – Here’s the sad part for the franchisee. Using ONLY fixed operating costs, this franchisee will have to fill 24 of his 28 suites (assuming $225 average rent, which is frankly generous in this case) just to break even! Our client’s equivalent number is 9, leaving lots of room for operating profit in the remaining 19 suites. Add other expenses (utilities, insurance, facility cleaning, supplies, phone, misc repairs, etc.), and the franchisee is realistically closer to requiring a break-even sublease rate of 26 out of his 28 suites(!). Now let's assume that he fills to capacity, and he's making a profit off those last two suites at $225/week. (We're actually being generous here because we're not even considering his additional royalties) That equates to an annualized net of about $23,000, on an investment of over $900k. All those that think this is a good business plan please raise your hand. Note: This SCG client understands the meaning of a competitive environment, so we included several design upgrades, which resulted in a beautiful facility, inside and out. In our opinion, the client’s property is easily equivalent to the franchise property from a design and ambiance perspective, and it obviously it surpasses the cookie cutter franchise approach. Probably the most eye-opening aspect of this study is that this model is NOT an outlier. This example is just one of many, and is probably typical. Many, many franchisees are in operation around the country that are creating great gross revenue streams, but making very little money. Remember, this is fine with the franchisor's bottom line because their income is tied to the franchisee's gross revenue, not their net. There are a few realities associated with Non-Compete Agreements in general, and for cosmetology professionals in particular:

1. Stylists are NOT lawyers (and vice-versa, thank goodness). 2. Many stylists are a bit intimidated by legal issues, such as Non-Compete Agreements. 3. Salon owners KNOW THIS and use it to their advantage. 4. ALMOST ALL NON-COMPETE AGREEMENTS ARE UNENFORCEABLE (INVALID). As a leading provider of upscale salon suites facilities, we have seen it many times: a stylists wants to strike out on her own, make her own way, build her own business, finally make some REAL money, and take control of her own career. But she feels she can't because she signed a pesky Non-Compete Agreement (sometimes known as a Covenant Not To Compete) with her current employer, which says something like she can't leave and work as a stylist, usually within a certain distance from the current salon. So she is intimidated into staying, resigned to limiting her income and independence, fearful of her salon owner "coming after " and suing her if she leaves. Understandably, this strikes more than a little fear into the hearts of most people. Many salon owners know this and understand the power of intimidation, particularly on someone without the legal background and/or resources to understand that almost ALL Non-Compete Agreements are unenforceable (illegal). That's right, the Non-Compete Agreement that the stylists signed at her current salon is probably not worth the paper it's printed on, and the courts have consistently rendered most similar agreements invalid. Here's the deal (A Texas example, but most states are similar)- A few years ago, the Texas legislature passed the Covenants Not To Compete Act, and any Non-Competition Agreement in the State of Texas must adhere to its provisions. Among other things, a Non-Compete Agreement must have several elements to make it valid: protect a legitimate business interest, have reasonable limitations as to the scope of activity to be restrained, have reasonable geographic and durational limitations, and (most importantly) be ancillary to or part of an otherwise enforceable agreement at the time the agreement is made. Again, this example is specific to Texas, but check your state. Most are governed by similar statutes. So, what does it mean? A Non-Compete will typically say that if the stylist leaves the salon's employ, she can't work within a certain radius of the salon's location (usually 10 miles) doing the same kind of work done for the salon (cosmetology work), for a certain period of time (1 to 2 years). OK, pretty straight-forward so far, but the important part comes along in that last clause, "ancillary to or part of an otherwise enforceable agreement". What does that mean? Like many states, Texas is known as a "right to work" state, which essentially means that employment is "at will" (basically, the employee can leave any time, and can be terminated at any time). This is important because the Texas Supreme Court has held that an "at-will" employment relationship is not an otherwise enforceable agreement since it can be terminated at any time by either party. For this reason (here's the important part), a Non-Competition Agreement that is ancillary only to an "at-will" employment agreement is invalid, no matter how reasonable in scope on the other issues. In simple terms, that means that a Non-Compete Agreement that does not include other "independent consideration" (i.e. bonuses [and commissions are NOT bonuses], ownership in the salon, disclosure of confidential or proprietary information, etc.) , it is unenforceable, or not valid, no matter how reasonable the other provisions of the agreement may be. We have seen many Non-Compete Agreements, and have yet to find one that adheres to these requirements, which makes them legally invalid. Our experience has been that some salon owners are aware of this and others aren't, but that almost all use these agreements to intimidate stylists with no legal training and few financial resources to fight them. The stylists knowing and understanding her rights and a little law can free her to pursue her career the way SHE wants, preferably in your salon suites facility. For the salon suites operator, this is a huge issue. As operators ourselves, we will even offer to indemnify the stylist from potential legal fees, and defend them if required, if their current salon decides to pursue any action. We do this because we're confident we have no exposure. In our experience, we have never had a salon owner actually pursue a stylist, are unaware of any client of ours experiencing this, and have ever even heard of it happening. Most salon owners are not very legally sophisticated themselves, and will not deem it to be worth the hassle to pursue the stylist, especially when considering the futility and expense. At SCG, we understand the salon suites industry and the major players, and attempt to keep up to speed on latest developments. We have become aware one of the highest profile salon suites franchisors is being shopped around to private equity groups.

While we have no specificity regarding future plans or motivations for the current or new ownership groups, in most transactions of this nature, this means that the founders are trying to cash out. Typically, a professional investment group will step in to run the operation as the founders depart. It is common that when a family-owned operation changes to an investor-run entity, the focus can change considerably. Often, franchisees who bought into the company because they felt that the founders were "good folks" that could work with them, and with whom they had a personal connection, find themselves dealing with corporate suits that have an entirely different approach and objectives. As it has been explained to us, among the selling points that this particular franchise has indicated to potential private equity buyers is that they are leaning away from additional franchises and towards more corporate-owned facilities. Our analysis indicates that is likely due to potential franchisor interest waning as folks exploring the concept become more educated as to the waste of money that suites franchise royalties represent. (We remain extremely skeptical of their claim that they will double the number of franchises in the next calendar year.) Who cares? Well...franchisees should...and they should care a lot! Again, we don't know the motivations of this particular ownership group, nor the details of this specific franchise agreement. We're only addressing business ownership changes as they pertain to franchises of all types. The development of corporate-owned facilities is potentially very bad news for current or interested franchisees that hold an exclusive territory license. Often, franchisors exempt themselves from territorial restrictions in the fine print of the franchise agreement (which most franchisees don't bother to read). Under this scenario, existing franchisees are looking at the possibility of competing with a well-funded corporate facility in their neighborhood since fewer open territories are available. With a private-equity owner, the emphasis is typically on corporate growth, without regard to potential damage to the small franchisee. When this particular franchisor started selling franchises, they were one of the earliest players, but now, there are at least six legitimate salon suites franchises operating (Phenix, Sola, My Salon Suite, A Suite Salon, Salons By JC, Salon Lofts, etc.). Our guess is that historic franchise growth rates are unsustainable given the current competitive market and a more educated potential operator. The low-hanging fruit of gullible franchisees has already been harvested, so they have little choice but to change direction and self-develop. Selling out is the logical direction of any salon suites franchisor, so it would be wise for the potential franchise owner to tread carefully for ANY salon suite franchise since the same exposure potentially exists in all of them. Even if your franchise is not being actively marketed, we believe it soon will be. The opportunity to cash out to the tune of millions of dollars is the main reason for building ANY company, and we certainly do not blame anyone for that! The downside is the potential exposure to the franchisees, who are paying those huge monthly royalties for...what was it again? The list of reasons for avoiding salon suites franchises keeps getting longer and longer. Our prediction of the collapse of the salon suites franchising concept is coming to fruition. We keep hearing stories (from folks who are exploring the franchise route) about the rapid decline of franchise fees across all franchisors. Franchises appear to be getting desperate for new operators, and are dropping their initial franchise fees to all-time lows in an attempt to protect their long-term royalty revenue streams.

As we predicted, with so many salon suites franchisors operating, the competition for franchisees has become heated. More significantly, the low hanging fruit of gullible, uneducated franchisees is drying up as more and more potential operators realize that the franchise model is a long term money pit for which they get nothing in return. The good news, if there is any, is that the cost for the initial franchise fee is becoming more closely correlated to the support and services that franchisors actually provide. We field many calls from new franchise owners asking for help because they can't get their franchisors to return their calls or emails as they try to develop their facilities. As we have mentioned previously, it appears to be a fairly common practice for franchisors to sell a great opportunity with lots of support, only to disappear once the initial franchise check has cleared. We have already documented an example of how the franchisor should have NEVER allowed the operator to develop an enormous facility in a super-dense area (see our post of May 2014 below). Now an operator on the west coast, who purchased multiple franchises, is having trouble getting financing together, but already executed a lease and is facing some serious problems as he has no capital for development. Why would a franchisor allow an operator to execute a lease without financing in place, or at a minimum, at least counsel them to make the lease contingent upon funding? Is this not obvious? To us, this is mystifying, but we keep hearing the same stories. Go with the professionals. Salon suites are great businesses, and there are great opportunities out there. It's just the franchise model that is...how shall we say it?...sub-optimal. In order to stay up on the industry and its latest trends for our clients, we routinely interview owners of recently opened or under-construction salons suites facilities, franchised or independent, and then follow up a year later to gauge their experience. One of our partners had an hour-long phone call this week with a recent franchisee of one of the “big six” franchisors. Here's what he told us:

This franchisee was pretty smug and confident when we started our discussion, but by the end of our talk, I think he was seriously regretting his decision, realized there wasn’t anything we could do for him, and that he was stuck. He paid a $45,000 franchise fee, and in return he essentially got a set of guidelines, a pat on the back and a “go get ‘em tiger”. No help with site selection other than some advice on rejecting a few locations, no site due diligence (a major issue was revealed during demo), no lease advice from the franchise or verbiage that would hold the landlord accountable for something like that, no design or space planning, some ridiculous marketing advice and was (in our opinion) sold a bill of goods regarding the strength of his position and the competition, which is significant. He was basically on his own. From the numbers he shared, he may never get a return on his capital and it is going to take him a very long time just to get to break even on monthly cash flow (if he ever does). The loss of his retirement nest egg is a very real likelihood. During our conversation, he told shared several reasons why he invested in the franchise and chose his location. 1. "Beautiful facility design advantage" He was convinced by the franchisor that his product will allow him to compete easily in any market. ("The quality of my product is so great that we won't have problems attracting tenants.") The reality is that three other operators in very close proximity also have quality product (beautiful facilities), with a fourth to be built soon. He seemed to not realize that once a certain design threshold is met, the advantage of one over the other becomes an issue of personal taste, with no advantage for this franchisee. We pointed out that none of his competition is a "ghetto" facility and any advantage he thinks he has is one of subjective taste. The design advantage scenario might be realistic for a new operator moving into an area with an old, run-down or dated facility, but the perceived advantage of a "beautiful design" diminishes or is eliminated when other operators have reached that same threshold. Later, after reviewing his plans, it was obvious that in an attempt to squeeze as much rentable space as possible into the facility, he had created suites that are typically smaller than his competition. While on the surface that might not seem significant, tenants are VERY aware of this, as they carefully evaluate a space since they will be spending so much of their time there. 2. "Financial advantage" His site has three other operators in his direct vicinity (with another planned), all independents with no royalty obligations, but somehow he has been convinced by his franchisor that he can compete with them even though he has a burden of nearly $40k/year in royalty fees that his competition does not have (not to mention his huge up-front franchise fee). That's like starting a marathon carrying a 30lb backpack. Since he didn't get much help from the franchisor with his lease (he was directed to find a local broker for help (another bad idea)...more on that later), he ended up with what he thought were great lease terms, when in fact, they are not competitive at all. Additionally, in order to establish his franchise, he has taken on a huge debt load, a burden that at least two of this three competitors do not have. So in summary, he is carrying a royalty obligation, bad lease terms, and a huge debt load, and now he has to go compete? That backpack just got loaded to about 75 lbs. 3. His market's over-supply of product/competitive evaluation After we reviewed his "design and financial advantages", we talked a bit about his market. He located his facility right across the street from a long-established independent, and within a quarter mile of two other facilities that had opened within the last year and are only about 30% filled. In his direct vicinity, there are approximately 40 open suites available, and he is adding 37 more to the market. Additionally, the long-established operator across the street from him has ten facilities in the area, and is planning another about five miles away. Historically, when this operator opens a new site, he partially populates it with tenants from his other facilities that live closer, so chances are that another 10-20 suites will be added to the market, all of them in beautiful facilities. That brings the total of available suites to roughly 90-100 (a HUGE number in just a quarter-mile radius). It is likely to take him years to fill his facility to a break-even point. This problem is exacerbated by the fact that one of these other operators appears to be in a desperate cash-flow situation and has been steeply discounting his suites, driving down the price for all operators in the area. 4. Pro forma analysis This franchisee told us that he has $850k(!) into the project (includes everything: franchise fees, construction, start-ups costs, etc.). While on the phone we plugged his numbers into our spreadsheet, and we were was just astonished. Not even having all the information, it appears that, in a BEST CASE scenario, with aggressive occupancy and high lease rate assumptions, he will net about $40-$50k per year. That is not a very good ROI on an actively managed investment, and he likely has 18-24 months of negative cash flow until then. While his position is that he only has a small portion of his own capital invested, he seemed to not realize that his highly leveraged start-up has him personally on the hook for that huge amount through personal guarantees, and will prevent him from expanding once he submits his balance sheet to get more funding for future facilities. 5. What he got from his franchisor As we continued our discussion, he explained that he was starting to realize that he didn't get much help from his franchisor. He was provided with a set of guidelines, some encouragement and some exciting stories about other franchisee's successes, and then was essentially released to build his business. (He also told me about the marketing advice he received, some of which bordered on the ridiculous.) Some due diligence and a guiding hand from an experienced operator would have gone a long way to helping him avoid much of this, but for the most part, he realized that he was on his own. The worst part was that if he could make this work and wanted to expand, he was stuck in a obligation to the franchise, so there was no way out. Summary So much went wrong with this, but it’s a common story. This poor franchisee likely has some sleepless nights ahead of him. At the end of the day, the franchisor has his money and a significant percentage of this poor guy’s future revenue stream…and for what? We feel badly for him, truly. Anyone going into a franchise situation should be aware of what is truly deliverable and what isn’t. Our experience generally is that franchisees are on their own much more than they expect to be. Don't be taken in by someone else's success story. Every market is different, and the risk is too high to not perform due diligence seriously and thoroughly. So far, not a single franchise has stepped up to take our challenge on the value of ongoing royalty payments. <sound of crickets chirping> So here's another, hopefully easier one:

What does the franchisor provide for the $45,000 franchise fee besides the right to put his name on your building, a pat on the back and a "Go get 'em, Tiger"? Let's list the potentials (results are typical across franchisors):

|

Welcome to our BlogWe hope you find something useful here. Don't hesitate to contact us if you have any questions! Archives

April 2020

|

If you have your heart set on buying a franchise and taking on the huge additional costs they incur, there are at least 23(!) by our count operating today: Sola, Phenix, Salons by JC, A Suite Salon, My Salon Suite, Studio Salons, Salon Spa Suites, Salon Plaza, Cirque Salon Studios, Image Studios 360, Salon Boutique, Universal Salons, Mimosa Salon Suites, Encore Salon Suites, Cosmopolitan Suites, Salon Concepts, Mix Salon Studios, Beauty Bungalows, Salon Studios, Spectra Salon Suites, Utopia Modern and Optima Salon Suites. Shop around, but why bother? You can accomplish the exact same objective at a fraction of the price. See how by clicking here.

RSS Feed

RSS Feed